Insurance Planning

More Than Protection: Insurance as a Strategic Asset Class

Most people think of insurance as a backup plan something that steps in when life takes an unexpected turn. And while that’s true, the right insurance plan can also be a strategic asset one that helps you grow wealth, preserve your estate, and create long-term financial stability.

I help professionals and business owners use insurance not just for protection, but as part of a broader financial strategy. When structured properly, insurance becomes one of the most powerful tools to reduce taxes, create liquidity, and build a legacy with confidence.

Why Insurance Planning Matters

You’ve worked hard to build your career, grow your business, and support your family. But if life takes an unexpected turn whether it’s an illness, injury, or untimely passing the financial impact can be significant. And without the right plan, everything you’ve built can also be eroded by taxes, market volatility, or a lack of liquidity when it’s needed most.

- Replace lost income for your family

- Provide tax-free access to capital during retirement

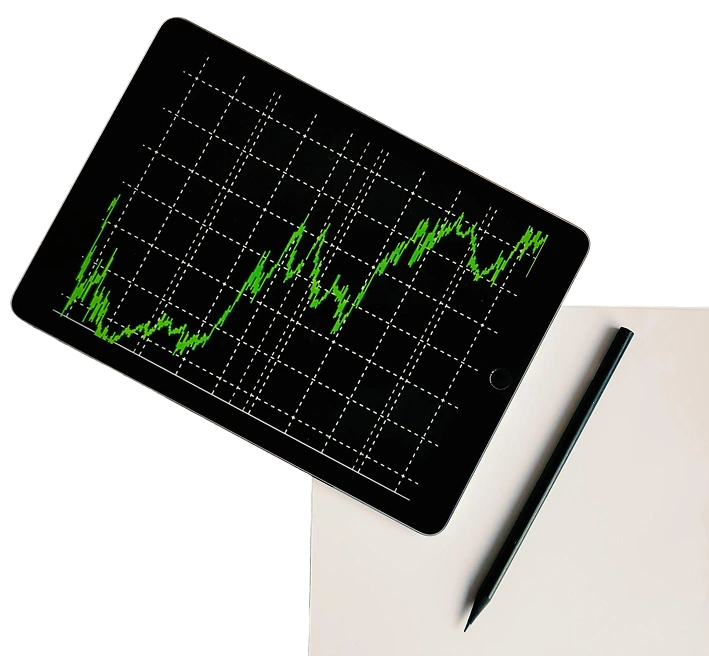

- Offer stable, long-term growth outside of traditional markets

- Ensure estate taxes are covered in a cost-effective, tax-efficient way without reducing your family’s inheritance

- Create lasting impact for the causes you love, while preserving more for your family

Two Roles. One Purpose.

Your insurance plan should first protect what matters most

- Your family’s financial security

- Your business continuity

- Your income in case of illness or injury

- Your legacy if something happens too soon

Beyond protection, insurance can also work for you as an asset class

- Generate tax-sheltered growth over time

- Create tax-free retirement income

- Reallocate corporate retained earnings into a more tax-efficient vehicle

- Provide liquidity to support succession planning or shareholder buyouts

Why Choose Me

A Relationship Built on Trust and Results

My approach is client-first. I work with you, not for a product. With over 10 years in finance, I’ve helped clients grow real wealth, not just numbers on paper.

Let’s Work Together